Introduction – Why This Strategy Matters for Beginners

When I first started trading, I thought making money in Forex was just about predicting whether a currency pair would go up or down. I couldn’t have been more wrong. Without a clear beginner forex trading strategy, I was making random trades, chasing the market, and burning through my account.

After months of trial, error, and some painful losses, I finally developed a simple, rule-based strategy that flipped my results from negative to consistently profitable. It’s easy enough for a beginner to follow, but powerful enough to work in real market conditions. In this article, I’ll walk you through the exact mechanics, examples, and mindset you need.

I believe reading is learning by heart — videos may show you the idea, but only reading lets you truly digest it. In trading, the heart decides the call while the mind manages the risk.

Step 1: Choosing the Right Currency Pairs

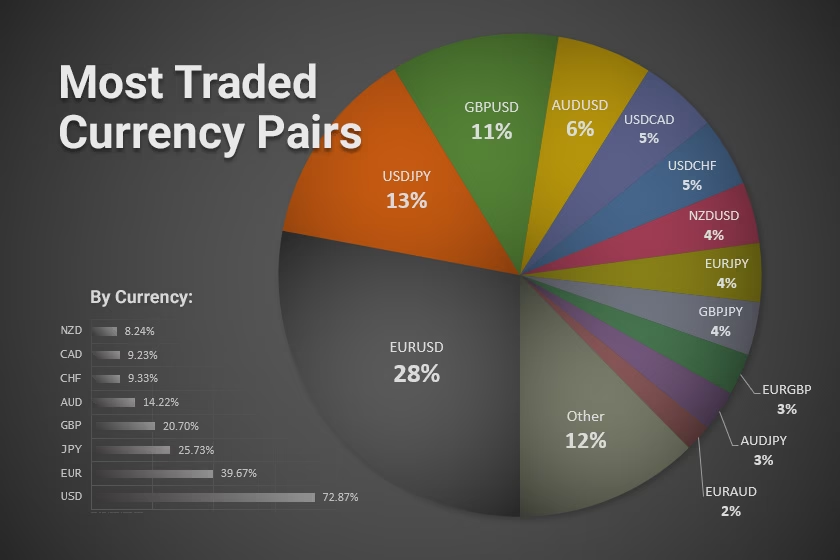

A common beginner mistake is trading every pair that looks “active.” Instead, start with major pairs like:

- EUR/USD – The most traded pair with low spreads

- GBP/USD – More volatile, good for slightly bigger moves

- USD/JPY – Predictable trends for beginners

Why majors? They have high liquidity, meaning you can enter and exit trades quickly, and they react more reliably to news.

Example:

If you’re trading EUR/USD, spreads are usually around 0.1–1 pip on most brokers. That’s important because smaller spreads mean less cost per trade, especially when you’re taking multiple trades per day.

Step 2: The Trading Timeframe – Stick to One

As a beginner, you should avoid switching between too many timeframes. My strategy focuses on the 1-hour chart (H1).

Why?

- The H1 chart filters out random noise seen in lower timeframes.

- It’s easier to see trend direction and key levels.

- You only need to check your chart every hour, reducing emotional mistakes.

Example:

On the EUR/USD H1 chart, if price is consistently making higher highs and higher lows, you’re in an uptrend — trade only in that direction.

Step 3: Entry Rules – The EMA + RSI Confirmation Strategy

This beginner forex trading strategy is based on combining two indicators:

- 50 EMA (Exponential Moving Average) – Shows overall trend direction.

- Relative Strength Index (RSI) – Confirms if the market is overbought or oversold.

Rules to Enter a Buy Trade:

- Price is above the 50 EMA (trend is up).

- RSI is between 40–60 and rising.

- Wait for a bullish candle close before entering.

Rules to Enter a Sell Trade:

- Price is below the 50 EMA (trend is down).

- RSI is between 40–60 and falling.

- Wait for a bearish candle close before entering.

Example:

EUR/USD is above the 50 EMA, RSI is at 45 and pointing upward, and a bullish candle just closed — enter a buy trade.

Step 4: Stop Loss & Take Profit – Protect Your Account

Even the best setups fail. A solid risk plan is what keeps you in the game.

Stop Loss Rule: Place your stop loss 10–15 pips below the recent swing low (for buys) or above the recent swing high (for sells).

Take Profit Rule: Aim for 1:2 risk-to-reward ratio. That means if your stop loss is 15 pips, aim for 30 pips profit.

Example:

If you enter a buy trade at 1.1000 on EUR/USD with a 15-pip stop loss, your take profit should be 1.1030.

Step 5: Money Management – The True Game Changer

Even a beginner forex trading strategy will fail without good money management.

Golden Rules:

- Risk only 1–2% of your total capital per trade.

- Avoid trading during major news releases (check Forex Factory calendar).

- Limit yourself to 2–3 trades per day.

Example:

If your account is $500, risk no more than $5–$10 per trade. This ensures a losing streak won’t blow your account.

Step 6: Review & Improve – Learning from Your Trades

Keep a trade journal where you write:

- Date & time of trade

- Currency pair

- Entry & exit prices

- Reason for entry

- Result (win/loss)

This will help you spot patterns in your success and mistakes.

Example:

You might notice that most of your losing trades happen when you ignore the EMA trend. That’s your cue to stay disciplined.

Conclusion – Why This Works for Beginners

This beginner forex trading strategy works because it:

- Filters trades using the trend (EMA).

- Confirms momentum with RSI.

- Manages risk with strict stop loss and take profit rules.

If you stay consistent and follow the rules without letting emotions take over, you’ll see a noticeable difference in your results. Remember, the market rewards discipline, not gambling.

You May need to Read

- Top Forex Trading Tools & Resources Every Trader Should Use in 2025

- Basic Forex Terms You Must Know (From My Personal Experience)